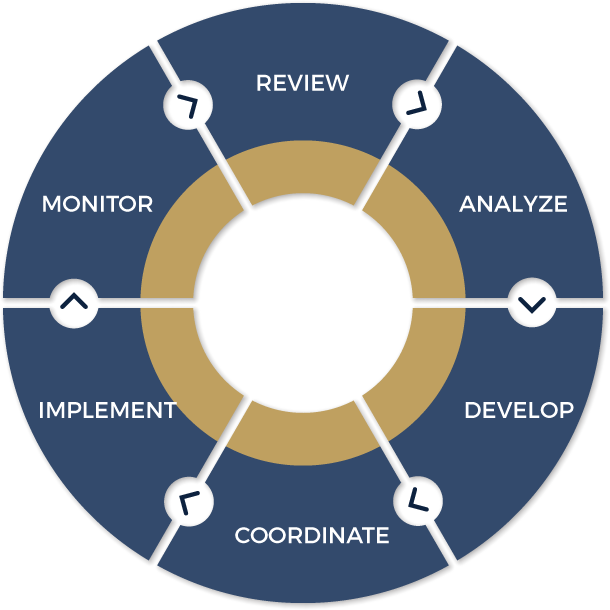

Turning Drive into DirectionWe all want to know that our efforts are propelling us toward a rewarding future, whether by creating a legacy through a family business or by maximizing retirement benefits to move forward securely. If you want to ensure your efforts are really getting you somewhere, you have to have vision and focus, particularly when it comes to your financial planning. The problem is, you might not know what resources you have or how to make them work for you. This can leave you feeling like you’re falling behind, no matter how hard you work. As someone who entered a new career in the middle of her life, our founder, Karin, knows what it’s like to have perseverance and determination to be successful. If you’re willing to put in the work to get ahead, you deserve to achieve your goals. You need an advisor to guide you in the right direction. That’s why Karin spent years training and educating herself on the intricacies of financial planning for businesses, professionals and families. She can help others with the same determination to move forward and to reach their goals. FounderKarin Feldstein is the founder and principal of Persevere Wealth Strategies, a comprehensive wealth strategies firm. Karin works with a wide variety of clients, including business owners, executives, families and individuals. When Karin is working with a client, she takes the time to learn about their goals, concerns, and risk tolerance so that she can tailor a financial plan according to their needs.  ProcessOne thing our clients appreciate about working with us is that we don’t believe in a standard approach. Instead, we follow a meticulous process designed to evaluate each client’s situation, goals, and level of risk tolerance. Then we can make appropriate recommendations to meet their financial needs. Everyone is different, and we will refine our approach to suit each client. We utilize the following process to help those we’re privileged to serve. Step 1: ReviewEvery client’s financial situation is unique. That’s why it’s important to find out as much as we can about you and your financial goals. The more we know about you, the more our precise recommendations can help you. As a result, we take time to discuss your aspirations and objectives, and prioritize what is most important to you. This is the basis for any first meeting. Step 2: AnalyzeWe work with you to identify and prioritize your objectives, and then help to establish benchmark goals. People often achieve targets when having realistic expectations. With careful consideration of specific objectives and available resources, desired results can be achieved. Step 3: DevelopBased on our conversation and analysis, we can recommend the steps that it will take to help you achieve your financial goals. Step 4: CoordinateWe regularly coordinate insurance and financial activities for clients with the other members of their own team of financial, tax, and legal advisors. We can do the same for you. Step 5: ImplementWe'll implement your strategy, and work closely with you and your other third party professionals to ensure its success. We'll monitor progress and provide ongoing service as your needs and situation change over time. Step 6: MonitorStrategies need to be adjusted periodically as your life and the economy changes. We will work with you over the years to help keep your strategy on track with your changing needs.  Client Login |

Persevere Wealth Strategies | Saddle Brook, NJ

Contact Us

250 Pehle Ave , Suite 900

Saddlebrook,

NJ

07663

- CA Insurance Lic. #: 0L88374

- E-mail address: kfeldstein@ft.newyorklife.com